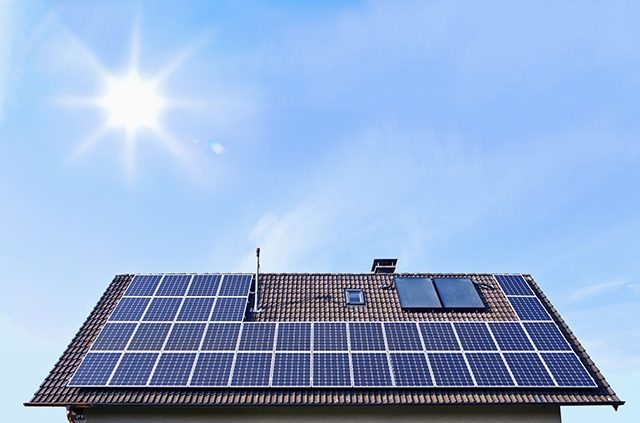

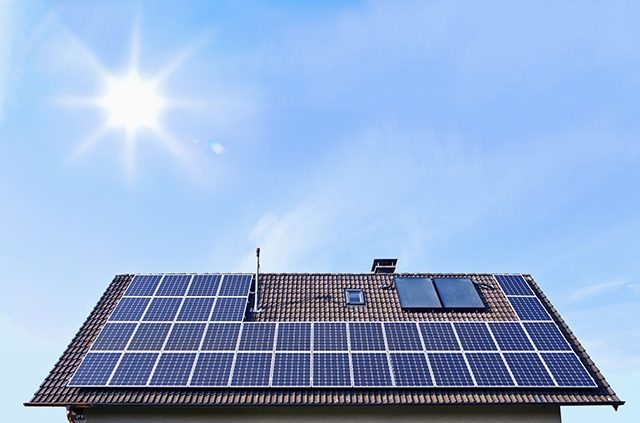

Ny state solar does more solar projects through the ny sun on bill recovery program than anyone else in new york state.

New york state solar power rebate.

As a part of its ambitious reforming the energy vision initiative 2 new york is making solar accessible to households across the empire state.

New york solar power overview.

New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less.

The final word of new york solar incentives and policy.

New york residential solar tax credit.

Solar incentive and financing options.

The state offers a balanced mix of good solar incentives and relatively high electricity prices that makes home solar in new york a very attractive financial investment.

New york state has a great solar rebate program under the new york state energy research and development authority nyserda ny sun program.

You will need to work with a nyserda approved participating contractor to find out if you are eligible for ny sun incentives.

Hopefully new york s leaders will continue their fine work and keep incentive programs and good laws alive for homeowners who want to go solar.

With offices in hicksville farmingdale and ronkonkoma we are your local solar professionals.

Trust the experts for a hassle free experience.

If your property isn t ideal for solar panels or you are not a homeowner community solar may be right for you.

Ny sun is an umbrella program for a number of solar industry support mechanisms in new york state including but not limited to the megawatt block incentive structure.

Ny sun in conjunction with nypa also provides the backbone for the state s community solar and k solar programs.

How much is the credit.

The system must also be installed and used at your principal residence in new york state.

Ny sun works directly with solar contractors and developers to offset the cost for new york residents to go solar.

Incentives are provided directly to your selected contractor and vary throughout the state.

Learn how you can benefit from new york s solar incentives rebates tax credits today.

New york is a top 10 solar state 1 and for good reason.

Guidance on determining federal and or new york state tax credit eligibility.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

The solar energy system equipment credit is not refundable.

This rebate incentive is called the megawatt block incentive as the watt rebate amount varies based on which block the incentive is reserved under for different areas.

For now the state earns its a grade with flying colors.

A similar tax credit is available at the state level for systems up to 25 kilowatts in capacity.

Other new york solar programs and incentives the ny sun initiative.

Thanks to rebates solar tax credits and exemptions new yorkers could earn back up to 40 on the up.